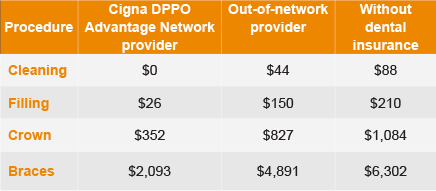

Cigna DPPO Advantage Network:

Dentists that have contracted with Cigna and agreed to accept a predetermined contracted fee for the services provided to Cigna customers. Visiting a provider in this network means you’ll save the most money, because the fee is discounted.

Out-of-Network:

Providers who have not contracted with Cigna to offer you savings. They charge their own standard fees.

Calendar Year Maximum:

The most your plan will pay during a calendar year (12-month period beginning each January 1st). You’ll need to pay

100% out-of-pocket for any services after you reach your calendar year maximum.

Lifetime Maximum:

The most your plan will pay during your lifetime. You’ll need to pay 100% out-of-pocket for any services after you reach

your lifetime maximum.

Coinsurance:

Your share of the cost of a covered

dental service (a percentage amount).

Calendar Year Deductible:

The dollar amount you must pay each

year for eligible dental expenses before

the insurance will pay.

Lifetime Deductible:

The dollar amount you must pay once in your lifetime for eligible dental expenses before the insurance plan will pay.

Maximum Allowable Charge (MAC):

The most Cigna will pay a dentist for

a covered service or procedure for

out-of-network dental care.

Standard Fee:

The fee that a provider charges to

a patient for a service who does not

have dental insurance.

Contracted Fee:

The fee to be charged for a service that Cigna has negotiated with a contracted provider on your behalf.